DASHBOARD

MODULES

Golden 52

Provides learners with up-to-date financial knowledge and best practices.

- Current & Relevant: Provides learners with up-to-date financial knowledge and best practices – Linked to OECD format

- Structured Learning: Logical progression ensures knowledge builds upon previous lessons.

- Consistent Engagement: Weekly delivery keeps learners actively engaged and fosters a learning habit.

- Diverse Content: Snackable Two Minute Video First format caters to modern learning styles connected to quizzes.

Timeless Wisdom

Financial advice is enriched and grounded in biblical teachings.

- Deep & Moral Grounding: Financial advice is enriched and grounded in biblical teachings.

- Universal Relevance: Timeless biblical lessons offer universal financial insights and wisdom.

- Holistic Approach: Marries the practical with the spiritual for comprehensive financial education.

- Time-Tested Wisdom: Biblical teachings have withstood millennia, highlighting their enduring value.

Rich Anytime

Allows learners to access and absorb content at their convenience and interest.

- Self-paced Learning: Allows learners to access and absorb content at their convenience and interest.

- Diverse Content Repository: Rich range of topics ensures learners can delve into areas of personal interest from a standardized format known as the Frame

- Continuous Engagement: On-demand access ensures learning isn’t restricted to structured sessions.

- Real-time Application: Immediate content access helps learners make informed financial decisions in real-life situations.

Overall Structure of Curriculum

BUCK Academy is an innovative educational platform designed to instill financial literacy in children, ensuring they grow up to be prudent savers and smart investors. Built around the personified character BUCK – a symbolic dollar that educates on the basics of money management – the platform is a unique blend of gamification, behavioral psychology, and biblical wisdom.

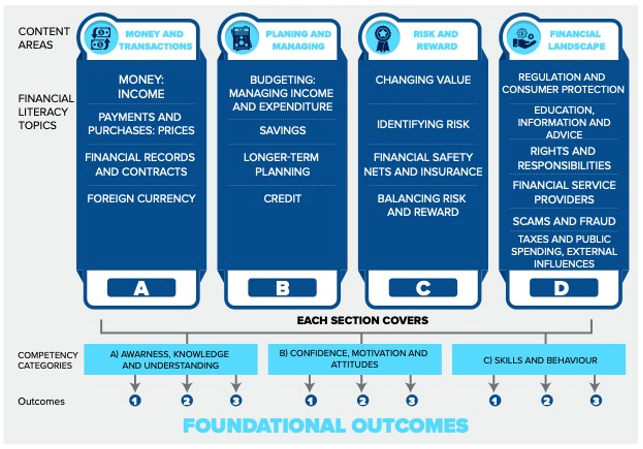

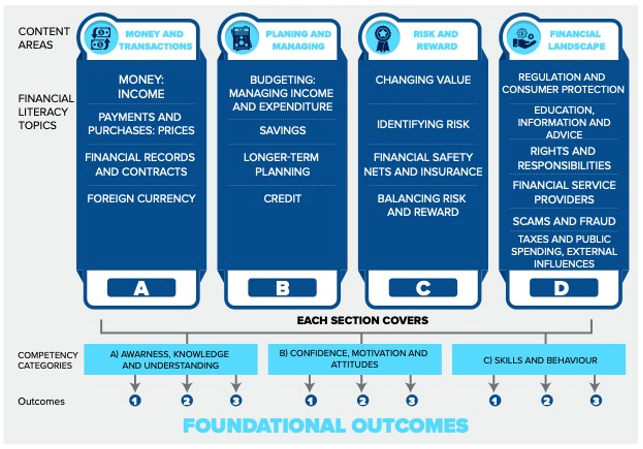

The BUCK Academy Financial Intelligence Pillars, as outlined below, focuses on the delivery of a Curated Curriculum on a weekly system. Otherwise known as the Golden Drip. The application is a strategic and intentionally structured systematic approach to financial education that provides significant value to youth learning how to manage their financial behaviors and ultimately gain financial intelligence.

EDUCATIONAL PILLARS

- The Golden Drip (Curated Curriculum delivered Weekly)

- Current & Relevant: Provides learners with up-to-date financial knowledge and best practices – Linked to OECD format.

- Structured Learning: Logical progression ensures knowledge builds upon previous lessons.

- Consistent Engagement: Weekly delivery keeps learners actively engaged and fosters a learning habit.

- Diverse Content: Snackable Two Minute Video First format caters to modern learning styles connected to quizzes

- Timeless Wisdom:

- Deep & Moral Grounding: Financial advice is enriched and grounded in biblical teachings.

- Universal Relevance: Timeless biblical lessons offer universal financial insights and wisdom.

- Holistic Approach: Marries the practical with the spiritual for comprehensive financial education.

- Time-Tested Wisdom: Biblical teachings have withstood millennia, highlighting their enduring value.

- RICH ANYTIME:

- Self-paced Learning: Allows learners to access and absorb content at their convenience and interest.

- Diverse Content Repository: Rich range of topics ensures learners can delve into areas of personal interest from a standardized format know as the Frame.

- Continuous Engagement: On-demand access ensures learning isn’t restricted to structured sessions.

- Real-time Application: Immediate content access helps learners make informed financial decisions in real-life situations.

DASHBOARD

Golden 52

Provides learners with up-to-date financial knowledge and best practices.

- Current & Relevant: Provides learners with up-to-date financial knowledge and best practices – Linked to OECD format

- Structured Learning: Logical progression ensures knowledge builds upon previous lessons.

- Consistent Engagement: Weekly delivery keeps learners actively engaged and fosters a learning habit.

- Diverse Content: Snackable Two Minute Video First format caters to modern learning styles connected to quizzes.

Timeless Wisdom

Financial advice is enriched and grounded in biblical teachings.

- Deep & Moral Grounding: Financial advice is enriched and grounded in biblical teachings.

- Universal Relevance: Timeless biblical lessons offer universal financial insights and wisdom.

- Holistic Approach: Marries the practical with the spiritual for comprehensive financial education.

- Time-Tested Wisdom: Biblical teachings have withstood millennia, highlighting their enduring value.

Rich Anytime

Allows learners to access and absorb content at their convenience and interest.

- Self-paced Learning: Allows learners to access and absorb content at their convenience and interest.

- Diverse Content Repository: Rich range of topics ensures learners can delve into areas of personal interest from a standardized format known as the Frame.

- Continuous Engagement: On-demand access ensures learning isn’t restricted to structured sessions.

- Real-time Application: Immediate content access helps learners make informed financial decisions in real-life situations.

Overall Structure of Curriculum

BUCK Academy is an innovative educational platform designed to instill financial literacy in children, ensuring they grow up to be prudent savers and smart investors. Built around the personified character BUCK – a symbolic dollar that educates on the basics of money management – the platform is a unique blend of gamification, behavioral psychology, and biblical wisdom.

The BUCK Academy Financial Intelligence Pillars, as outlined below, focuses on the delivery of a Curated Curriculum on a weekly system. Otherwise known as the Golden Drip. The application is a strategic and intentionally structured systematic approach to financial education that provides significant value to youth learning how to manage their financial behaviors and ultimately gain financial intelligence.

EDUCATIONAL PILLARS

- The Golden Drip (Curated Curriculum delivered Weekly)

- Current & Relevant: Provides learners with up-to-date financial knowledge and best practices – Linked to OECD format.

- Structured Learning: Logical progression ensures knowledge builds upon previous lessons.

- Consistent Engagement: Weekly delivery keeps learners actively engaged and fosters a learning habit.

- Diverse Content: Snackable Two Minute Video First format caters to modern learning styles connected to quizzes

- Timeless Wisdom:

- Deep & Moral Grounding: Financial advice is enriched and grounded in biblical teachings.

- Universal Relevance: Timeless biblical lessons offer universal financial insights and wisdom.

- Holistic Approach: Marries the practical with the spiritual for comprehensive financial education.

- Time-Tested Wisdom: Biblical teachings have withstood millennia, highlighting their enduring value.

- RICH ANYTIME:

- Self-paced Learning: Allows learners to access and absorb content at their convenience and interest.

- Diverse Content Repository: Rich range of topics ensures learners can delve into areas of personal interest from a standardized format know as the Frame.

- Continuous Engagement: On-demand access ensures learning isn’t restricted to structured sessions.

- Real-time Application: Immediate content access helps learners make informed financial decisions in real-life situations.